Trends in Edible Oil Packaging Market 2025-2035

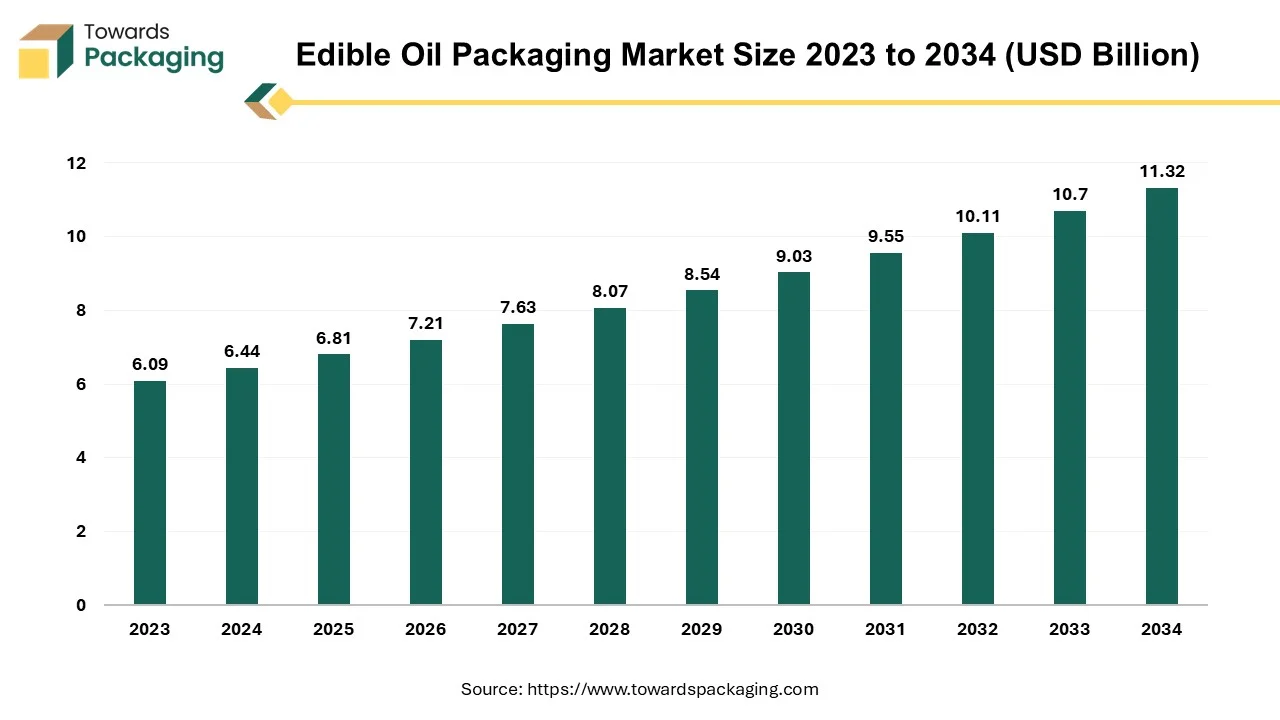

According to projections from Towards Packaging, the global edible oil packaging market is set to increase from USD 7.21 billion in 2026 to nearly USD 11.32 billion by 2034, reflecting a CAGR of 5.8% during 2025 to 2034.

Ottawa, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The global edible oil packaging market, which stood at USD 6.81 billion in 2025, is projected to grow further to USD 11.32 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research. This market is growing due to rising demand for safe, leak-proof, and longer shelf-life packaging, driven by expanding food consumption and urban lifestyles.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Insights

- By region, Asia Pacific has dominated the market, having the biggest share in 2024.

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By material, the plastic segment has contributed the largest market share in 2024.

- By material, the glass segment is expected to experience a notable CAGR between 2025 and 2034.

- By packaging type, the bottles segment contributed the largest share in 2024.

- By packaging type, the pouches segment is expected to experience a notable CAGR between 2025 and 2034.

- By distribution channel, the retail stores segment contributed the largest share in 2024.

- By distribution channel, the e-commerce segment is expected to experience a notable CAGR between 2025 and 2034.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5178

Key Technological Shifts

- Shift to lightweight PET bottles that reduce material use, cut transport costs, and improve shelf life.

- Adoption of multi-layer barrier films to protect oil from light, oxygen, and moisture.

- Growth of biodegradable & compostable packaging as brands move toward sustainability.

- Smart packaging features like tamper-evident seals, QR codes, and freshness indicators.

- High-speed automated filling lines to increase efficiency and reduce human error.

- Improved leak-proof caps & spouts for better handling and storage.

Market Overview

The edible oil packaging market is expanding steadily because consumers favor packaging formats that are hygienic, safe, and manageable. Manufacturers are being forced to use higher-quality materials like PET pouches and multilayer films due to increased urbanization and cooking oil consumption. Packaging that increases shelf life, stops leaks, and provides convenience is a focus for brands. Additionally, eco-friendly lightweight and recyclable products are becoming more popular due to sustainability trends.

Key Trends

- Rapid shift to PET bottles and pouches due to low cost, light weight, and easy handling.

- High demand for recyclable and eco-friendly materials as sustainability rules tighten.

- Growth of tamper-proof and spill-proof caps for better safety and convenience.

- Increasing use of multilayer barrier films to protect oil from light and oxidation.

- Smart packaging elements like QR codes and traceability labels are gaining popularity.

Opportunities

- Eco-friendly packaging development: Demand for recyclable, biodegradable, and lightweight materials is rising.

- Premium and smart packaging: QR codes, traceability, and anti-counterfeit features are gaining traction.

- Expansion in emerging markets: Higher edible oil consumption in India, Southeast Asia, Africa, and the Middle East.

- Automation & high-speed filling lines: Companies are upgrading machinery to boost speed and efficiency.

- Innovative cap & spout designs: Leak-proof, easy-pour caps improve convenience and reduce wastage.

- Growth in small pack sizes: Strong demand for 200 ml–1 litre packs in both urban and rural markets.

-

Customization & branding: Printed pouches and stylish PET bottles help brands stand out and attract buyers.

More Insights of Towards Packaging:

- Sustainable Plastic Packaging Market Size, Trends, and Growth Forecast (2025-2035)

- Packaging Waste Management Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

- Packaging Materials Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Clear Plastic Film Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Artificial Intelligence (AI) in the Packaging Design Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Glass Packaging Market Size, Segments, Trends, Regional Insights, Manufacturers, and Competitive Analysis

- Corrugated Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Food Packaging Market Size, Segments Data, Regional Analysis (NA, EU, APAC, LA, MEA), Competitive Landscape & Manufacturers Insights

- Flexible Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Rigid Plastic Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive Benchmarking, Value Chain & Trade Data 2025-2035

- U.S. Cosmetic Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Nonwoven Packaging Market Size, Growth, Trends, and Regional Insights (2025-2035)

-

Thermal Printing Market Size, Trends, Segments, and Regional Insights 2025-2035

Segmental Insights

By Material

Plastic segment, in 2024, dominated the edible oil packaging market because of its capacity to stop leaks, affordability, and light weight. Manufacturers frequently use plastic containers because they are durable and convenient for storage and transportation, particularly PET bottles and HDPE jugs. Additionally, plastic comes in a variety of sizes and shapes, which makes it simpler for companies to draw in customers with creative designs.

The glass segment is growing rapidly as consumers' preferences for high-end chemical-free packaging are growing. High-end edible oils like olive and cold-pressed oils are frequently kept in glass bottles because they retain flavor and aroma better. Growing health consciousness and consumer demand for reusable, eco-friendly packaging are major factors propelling glass packaging expansion.

By Packaging Type

The bottles segment dominated the edible oil packaging market because they are perfect for both home and commercial use and are simple to handle, store, and pour. Additionally, they enable tamper-evident sealing, labeling, and branding, all of which boost consumer confidence because bottles can be used with a variety of oil types and volumes that manufacturers prefer.

Pouches are witnessing rapid growth because of their affordability, light weight, and compact design. Smaller quantities and single-use packs are better suited for flexible pouches, which appeal to both urban and rural customers. In keeping with sustainability trends, they also lower material consumption and transportation expenses.

By Distribution Channel

The retail stores segment dominates edible oil sales because it enables consumers to directly compare brands and is widely accessible. Grocery store supermarkets continue to be the most popular option for large-scale purchases, accounting for a significant portion of the market. Retail displays also aid in promoting brands and increasing product visibility.

E-commerce is growing rapidly in edible oil sales because doorstep delivery is convenient, and internet usage is growing. Urban consumers looking for premium oils or value packs are especially drawn to online channels. Doorstep delivery services, subscription models, and digital promotions are all contributing to this segment of e-commerce growth.

By Region

Which Region Held the Largest Share of Edible Oil Packaging Market in 2024?

Asia Pacific is dominating the market because cooking oil consumption is high, particularly in nations like China, Indonesia, and India. The market is expanding due to urbanization of population growth and rising packaged oil demand. To satisfy the wide range of consumer preferences in the area, manufacturers are concentrating on introducing novel packaging solutions.

India Edible Oil Packaging Market Trends:

India is one of the largest and fastest-growing markets for edible oil packaging because household consumption is high and there is a strong need for reasonably priced long long-lasting formats like flexible pouches and PET bottles. Reliable packaging that stops leaks and preserves freshness is becoming increasingly important as branded packaged oil replaces loose oil. Manufacturers are under pressure to use creative, lightweight, and environmentally friendly packaging options for a variety of pack sizes due to growing urbanization, health consciousness, and the expansion of contemporary retail establishments.

North America to Grow Rapidly in Edible Oil Packaging Market:

The North America region is growing rapidly because of the growing demand for sustainable packaging options, high-quality edible oils, and convenience. Customers who are health-conscious favor premium oils that come in glass bottles, PET bottles, or pouches. The market's quick growth in this area is also being aided by rising internet sales and creative packaging designs.

U.S. Edible Oil Packaging Market Trends

The U.S. edible oil packaging market is expanding because consumers favor high-end oils like avocado, olive, and specialty cold-pressed oils, which call for premium packaging like multilayer PET containers and glass bottles. A key motivator is sustainability, with businesses concentrating on lightweight and recyclable materials to satisfy customer and regulatory demands. Innovation in bottles, pouches, and smart labels is also accelerating nationwide due to the growth of e-commerce and the need for practical spill-proof packaging in the U.S. marketplace.

Europe’s Pace in Bio-based Products to Promote the Growth of Edible Oil Packaging Market:

The European edible oil packaging market is driven by a strong demand, particularly for olive oil, seed oils, and specialty gourmet oils, for packaging formats that are high-quality quality sustainable, and recyclable because of their premium positioning. Glass bottles are still widely used, but as regulations tighten, recyclable PET and bio-based materials are gaining traction. Brands are being pushed toward lightweight, low-carbon, and tamper-proof solutions by consumers growing desire for safe, clean, and environmentally friendly packaging.

Germany Edible Oil Packaging Market Trends

Germany is a key market in Europe, driven by the rising demand for high-end edible oils that need high-barrier packaging, such as organic and cold-pressed varieties. Glass bottles are popular because consumers believe they are sustainable and pure, but recyclable PET and environmentally friendly pouches are becoming more and more popular. Packaging innovations that lower waste and extend shelf life are encouraged by strict environmental regulations and robust retail standards.

Middle East and Africa to Boom in Edible Oil Packaging Market:

MEA edible oil packaging market is expanding as urban lifestyles increase food consumption and the transition from loose to packaged branded oils occurs throughout the world. PET bottles and flexible pouches are popular because they are inexpensive and long-lasting in hot weather. Stronger leak-proof and aesthetically pleasing packaging formats are being introduced by manufacturers in response to growing retail modernization and rising demand for premium vegetable oils.

UAE Edible Oil Packaging Market Trends

The UAE market is growing steadily, as branded premium edible oils in premium bottles and pouches become increasingly popular among consumers. The clean appearance, ease of use, and hygienic advantages of glass and PET bottles make them popular. The demand for high-end end environmentally friendly, and tamper-evident packaging formats that guarantee product safety and freshness is being driven by the nation's robust retail infrastructure, high disposable incomes, and preference for imported specialty oils.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments

- In August 2025, STELDA, in collaboration with Spheretech Packaging India Pvt Ltd, launched the new ECOSEAL TCP 15 sealing machine designed specifically for 15-litre edible-oil tins. The solution enhances sealing accuracy, reduces manual handling, and supports fully automated filling-sealing-capping lines showcased at Anuga FoodTec 2025.

- In March 2025, UFlex became the first Indian company to receive approval from the US Food and Drug Administration (USFDA) for its recycled‑PE (rPE) recycling process for food packaging. This allows the use of recycled polyethylene in edible oil packaging, a major step in reducing plastic waste while adhering to food‑safety standards. UFlex also announced a ₹317 crore investment to expand recycling capacity at its Noida facility.

- In March 2024, Berry Global, in collaboration with Mitsubishi Gas Chemical Company, developed and began offering a recyclable, EVOH‑free barrier resin for food packaging, including potential use in edible‑oil pouches and bottles. This material maintains protective barrier properties while improving recyclability and reducing environmental footprint. This development reflects the industry’s shift toward sustainable packaging alternatives.

Market Companies

- Amcor Plc: Known for high-barrier, lightweight packaging solutions, they are a global leader in flexible and rigid packaging for edible oils.

- Berry Global Group: Specializes in spill-resistant PET and HDPE bottles, often utilized in high-volume production with advanced closure systems.

- Tetra Pak: Focuses on paper-based aseptic cartons with extended shelf life, providing sustainable, non-breakable options for liquid oils.

- Mondi Group: Focused on developing flexible, lightweight, and eco-friendly pouches, they emphasize paper-based sustainable alternatives to plastic.

- Huhtamaki Oyj: Accounts for an estimated 4-7% of the market, innovating with plant-based and compostable solutions across various formats.

- Smurfit Kappa Group: Specializes in paper-based and biodegradable solutions, including innovative bag-in-box systems for bulk edible oils.

- Sonoco Products Company: Offers high-barrier metal and composite containers, alongside flexible packaging options that prioritize shelf presence.

- Plastipak Holdings: Develops sustainable PET-based bottles, focusing on recycled content and circular economy initiatives.

- Crown Holdings Inc.: Focuses on aluminum and steel containers, providing robust, barrier-proof options for specific high-value oils.

- Sealed Air Corporation: Innovates with oxygen-barrier films to extend product shelf life, primarily using flexible rollstock materials for high-speed filling lines.

Segments Covered in the Report

By Material

- Plastic

- Glass

- Metal

- Paper & Paperboard

By Packaging Type

- Bottles

- Pouches

- Cans

- Drums

- Cartons

- Boxes

By Distribution Channel

- Retail Stores

- Ecommerce

- Supermarket

- Hypermarket

- Others

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5178

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Connected Food Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Next-Generation Packaging Market Outlook 2025-2035 Size, Share, Trends, and Growth Opportunities

- Biopolymer Packaging Market Global Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Value Chain Analysis

- Paper-Based Sustainable Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis Report

- Non-Recyclable Polystyrene Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis

- PET Packaging in Pharmaceutical Market Size, Trends, Segments, Regional Outlook, Value Chain and Competitive Landscape Analysis

- Europe Recyclable Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain, Trade & Supplier Analysis

- Sustainable Films for Packaging Market Size, Trends, Segmentation, Regional Insights (NA, EU, APAC, LA, MEA), Competitive Landscape, and Trade Data Analysis

- Packaging Waste Recycling Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Europe Pharmaceutical Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Europe Flexible Films Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

- Extra High-Performance Linerboard Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Regular Slotted Container (RSC) Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Plastic Packaging Market Size, Segment Data, Regional (NA/EU/APAC/LA/MEA), Companies, Trade Data, Manufacturers & Suppliers 2035

- Packaging Market Size, Trends, Segments, Competitive Analysis, Regional Dynamics with Manufacturers and Suppliers Data 2035

- Microplastic Recycling Market Size, Trends, Segments and Competitive Analysis, 2025-2035

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.